Well, this past week I reviewed my first “estate plan” from legal zoom. I’ve read about others’ reviews. In fact, I even referenced an article on do-it-yourself planning in a previous blog post. This, however, was my first look at a legal zoom estate plan for a potential client who wanted me to review it. I have to give this person a lot of credit for being willing to have it reviewed. To not just assume that everything was right (like many people), and to have an open and honest discussion about what it was . . . and more importantly, what it was not.

I’m not going to detail every question I had, every shortcoming of the plan and everything that was not how my potential client wanted it to be. To do that would take far too much time and you wouldn’t want to read all of it anyway. Instead, I will highlight a few of the items. To be fair, these are not just my thoughts as an estate planning attorney. Each of these items is something the potential client wanted changed because it didn’t work how he wanted it to. But how would he have known that while filling out the legal zoom questionnaire? He wouldn’t . . . more on that later.

Here are the biggest issues we came across while discussing the Legal Zoom “estate plan:”

- It wasn’t a comprehensive plan – it was just a living trust and a pour-over will. At a minimum, he should have also had a financial power of attorney and a healthcare power of attorney. Although the powers of attorney are important in every estate plan, they are particularly important in this gentleman’s situation due to his health condition. Sure, it could be that he chose only the trust/will combination while going through the Legal Zoom online questionnaire, and it shouldn’t be considered Legal Zoom’s fault that he did that. I’m not saying it’s anyone’s “fault,” but the fact is, without a good discussion about what estate planning is, what it is not, what is most important to him and what planning is needed to carry out his wishes, how could he have known?!

- This is probably second only to the one above. He had listed several people he wanted to receive varying shares of his estate. If someone passed away before they received their share, he wanted it to go to their children or, if they had no children, to the others he had listed. UH OH – that’s not what the trust said. It said that if any of the folks passed away, it would go to his “heirs” according to Michigan law, many of which were not people on his list and many who would receive much more than he wanted!

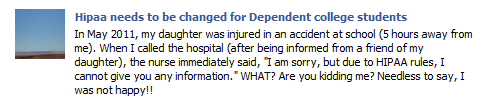

- There was no HIPAA authorization. This means that although he wanted a living trust to help keep his affairs out of court during life and after death, someone would have to go through the court process to be appointed as guardian if they needed access to his medical records. Definitely not what he wanted.

- Neither the will nor the trust had a reference to a written list of personal property. This would have allowed him to say who received what of his personal belongings without him having to change the will/trust each time. Honestly, I can’t remember reviewing a Michigan estate plan in the past few years that did not have this provision. I see this as a miss on Legal Zoom’s part.

- There were several typos in the documents (for example, the signature section for the trustee had all the trustees names under the signature line written like it was one long name . . . one very long name!). I don’t know if this was user error or programming error. Either way, it was a typo. Have I seen typos before? Sure, attorneys are humans too and we make mistake sometimes. However I’ve never seen one that blatant.

- Finally, although he had a living trust, it was not “funded.” That means that the trust didn’t own anything (read my blog post on the topic here). Ultimately, this meant that although he wanted to avoid the probate court process when he passed away, that would not be the case. Everything except his life insurance would go through the probate court process before it ended up in the trust and the life insurance would all go to one individual. See #2 above for why that would be bad.

Please know that the above list is by no means exhaustive. That is the list of the things that bothered my client the most. Oh yeah, notice how I changed the phrase to “my client?” He’s a client now. He wanted to make sure his estate plan was unique to his family situation and that it would work when needed . . . he didn’t feel the Legal Zoom “estate plan” did that.

I think he summed it up best at the end of the Peace of Mind Planning Session when he said, “wow – well, I guess I just didn’t know what I didn’t know. I’m glad I had you review it.”

If you have a “do it yourself” estate plan (Legal Zoom or otherwise) and would like the added Peace of Mind of having it reviewed, call us at 616-827-7596. The review is free and there is no obligation. Why leave it up to chance? Give us a call.

Michael Lichterman is an estate planning and business planning attorney who helps families and business owners create a lasting legacy by planning for their Whole Family Wealth™. This goes beyond merely planning for finances – it’s about who your are and what’s important to you. He focuses on estate and asset protection planning for the “experienced” generation, the “sandwich generation” (caring for parents and children), doctors/physicians, nurses, lawyers, dentists, professionals with minor children, family owned businesses and pet planning. He takes the “counselor” part of attorney and counselor at law very seriously, and enjoys creating life long relationships with his clients – many of which have become great friends.